Jerry counsels individual clients and closely held business owners on their estate planning, estate settlement, and tax planning needs. He provides practical, comprehensible solutions to complex planning issues.

He also advises individuals on wealth transfer planning, including charitable planning, and drafts implementing documents, such as wills, multiple types of trusts, and limited liability company agreements. Clients seek his experience and guidance to create sophisticated estate plans, including business succession plans, generation skipping transfers and plans for mixed families. He works cooperatively with banks and trust companies to benefit mutual clients. He also works with family members to maneuver through the estate settlement process.

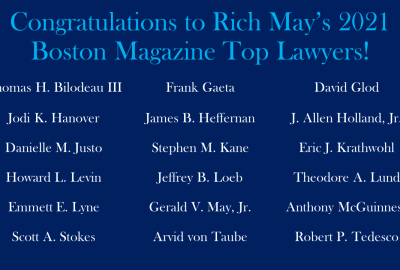

Awards & Honors

- Awarded the highest ranking by Martindale-Hubbell Law Directory (AV-Legal Ability Ranking: Preeminent)

- Named a “Top Lawyer” by Boston Magazine, 2021

Representative Matters

- Successfully navigated a gross estate in excess of $10 million through the IRS and Massachusetts return process.

- Implemented gift tax planning for use of the $5.12 million lifetime federal gift tax exemption.

Education

- Tufts University, B.A., 1967

- Suffolk University Law School, J.D., 1973

- New York University Law School, LLM in Taxation, 1977

Bar Admissions

- Massachusetts

Court Admissions

- U.S. Supreme Court

- U.S. Tax Court

- U.S. Court of Appeals, 1st Circuit

Outside the Office

- Jerry lives in Needham, Massachusetts with his wife Kathy. He is an avid sailor and a member of the Plymouth Yacht Club.